Hedge Funds Still Make Institutional Investors Squeamish |

Date: Sunday, September 2, 2007

Author: Christopher Holt, Seekingalpha.com

Several media outlets reported last week on a recent study by Northern Trust covering institutional investments in hedge funds. The central conclusion of the study is that pension plans seem not to walk their talk on hedge funds.

It’s true that the report, based on a survey of pension fund managers, questions why institutions are not yet comfortable with hedge funds. But a careful reading of it (available here) suggests that the genie is out of the bottle when it comes to the search for alpha. Institutional hesitation stems mostly from current hedge fund business practices. And while operational challenges remain a barrier to acceptance by some, the report clearly shows that institutions still value what hedge funds aim to deliver: alpha.

The study says that institutional investors fall into one of two categories:

…when it comes to their involvement in hedge funds, institutional investors fall into two groups: pragmatists and fundamentalists. The first group perceives hedge funds as but one of many credible strategies for generating alpha…the second group believes that investor appetite for hedge funds will evaporate as markets continue to recover. After all, many investors chase returns, not asset classes. [They believe] beta will remain the main source of wealth creation in the medium term.

And the ranks of the pragmatists - those who seek alpha in any of its organizational forms - are growing:

…interest in absolute returns is nothing short of the revival of the investment mentality of the 1960’s and 1970’s, before the rhetoric of relative returns and benchmark hugging blinded so many investors, so many times, for so long…On this argument, it is better to swim with the tide of absolute returns than go against it.”

Broadly defined, hedge funds are simply investment vehicles that aim to produce returns which are made up mostly of alpha, not beta. In other words, hedge funds are essentially “packaged alpha”. So unless they’re efficient market hypothesis diehards (and granted, some institutions are), they will almost certainly invest in hedge funds at some point - even if they don’t call them “hedge funds” by then.

What might they call them? Northern Trust provides some options:

…convergence [between hedge and traditional investing] is already evident, for example, with ever more hedge funds venturing into the absolute long only space. On their part, mainstream fund managers are emulating hedge fund type strategies (e.g. unconstrained investing; 130:30) and boutique structures within a far more competitive pricing model.

But this convergence is a two-way street. Ironically, the threats facing long-only managers may be as dangerous as those apparently facing hedge funds today. As the report continues:

…actively management funds are less active than they claim: many may be closet trackers, departing from the index only at the edges of their portfolio in order to distinguish themselves from the herd.”

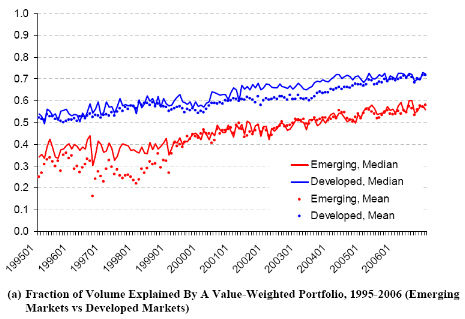

It goes on to cite research by Utpal Bhattacharya and Neal Galpan of Indiana University that shows over 70% of the volume traded on developed market exchanges each year can be explained by the market cap weights of each stock in the index. Here’s a chart from that report showing the correlation between volumes and value-weights on the vertical axis:

While the methodology may be a little aggressive in our opinion, the conclusion is undeniable: passive management is quietly invading financial markets.

The report doesn’t suggest that institutions have a problem with an alpha/beta separation paradigm, or even that they have collectively turned their backs on the search for alpha. Instead, they simply say that resistance to hedge funds is based on somewhat more superficial concerns (that we maintain will be easily rectified by the market):

…resistance boils down to investment basics: opaqueness, fees and performance.”

So maybe institutions want to walk the talk, but are just waiting for the light to change before walking. After all, isn’t that the safest way to cross the street?

Reproduction in whole or in part without permission is prohibited.