One of the effects of the Credit Crunch

of 2008/9 was that counterparty risk became a major concern. Who you

lend to, the quality of collateral, and documentation related to these

factors became major operational issues. In a climate in which it became

difficult to know for sure who would be around to deliver either

collateral or borrowed securities back again the next week, it was

inevitable that the willingness to lend declined. Graphic One

illustrates that the assets available to borrow fell by 30% in the 4Q of

2008.

Graphic One

The low point for lendable assets coincided with the low for equity markets in March 2009. As a result of implicit government guarantees and the move to bank holding company status for some banks, clients regained comfort with the securities lending market, and lendable assets have been increasing to pre-Crunch levels.

Whilst the willingness to lend has

returned to levels seen previously, the desire to borrow securities has

not returned to anything like the same degree. On-loan balances, that is

the amount of securities actually borrowed, remains at around half the

level seen in the first half of 2008 (see Graphic Two).

Graphic Two

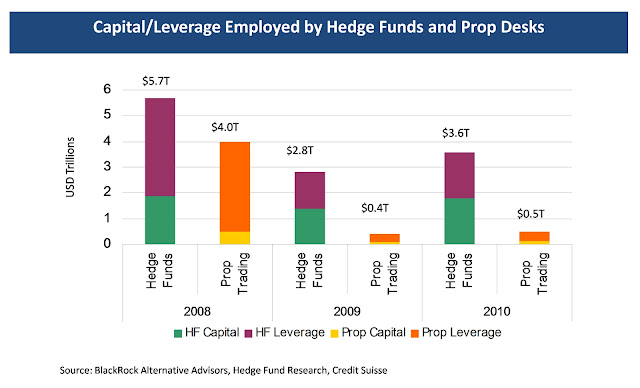

There are a number of reasons why the

volume of securities borrowed has declined and stayed at a new lower

level. The borrowers of securities would be hedge funds and proprietary

trading teams. Capital in the hedge fund industry dropped by 40% from

mid-2008 to mid-2009. In the period of the Credit Crunch proper the

capital used by prop desks was needed elsewhere in the businesses. In

the period after there were regulatory inhibitions on capital devoted to

prop trading. For both types of borrowers of securities many of the

those that engaged in running funds or prop capital had reduced risk

appetites or measured such high correlation and volatility in the

markets in which they traded that they need less capital to put the same

amount of risk on.

Graphic Three

Of course another, if not the, major

factor was that financing new borrowings of any sort became extremely

difficult - so leverage fell across all activities funded by short term

borrowing, including prop trading and hedge fund position financing. The

massive de-leveraging is illustrated in Graphic Three, which shows a 62%

fall in leverage from 2008 to 2010.

Capital allocated to prop desks today is

down by an estimated 90% from the 2008 levels, and will go lower as

banks such as Goldman Sachs and JP Morgan have announced they will

withdraw from the activity.

Securities are borrowed in order to

carry out a number of shorting strategies:

hedging activity to offset long exposures, arbitrage trading to capture

mispricing opportunities, and strategies to benefit from corporate

changes such as mergers

and acquisitions. Whilst there may still be a need for large scale

hedging, and there have been gross arbitrage opportunities in the last

18 months, the volumes of M&A deal flow have been down significantly

(see Graphic 4).

Graphic Four